The Difference Between Professional Indemnity and General Liability

Isn't Professional Indemnity Insurance the same as General Liability Insurance? No, but there are some misunderstandings surrounding this topic. In this article, we will explain the exact difference between Professional Indemnity and General Liability.

Professional Indemnity Insurance or General Liability: What's the difference?

Professional Indemnity Insurance and Public Liability Insurance are often perceived as the same by freelancers and the selfemployed. However, this is only partially true.

- A General Liability Insurance primarily covers personal injury and property damage. If the place of business consists of an office (commercial operation), the term Public Liability Insurance is often used.

- The term Professional Indemnity Insurance is often used as an umbrella term for different liability insurance policies – it can also include a General Liability.

In order to cover the professional risks of freelancers, self-employed and companies as comprehensively as possible, we at exali recommend Professional Indemnity Insurance, which includes both Financial Loss Insurance and General Liability Insurance.

Risk Coverage of Professional Indemnity Insurance

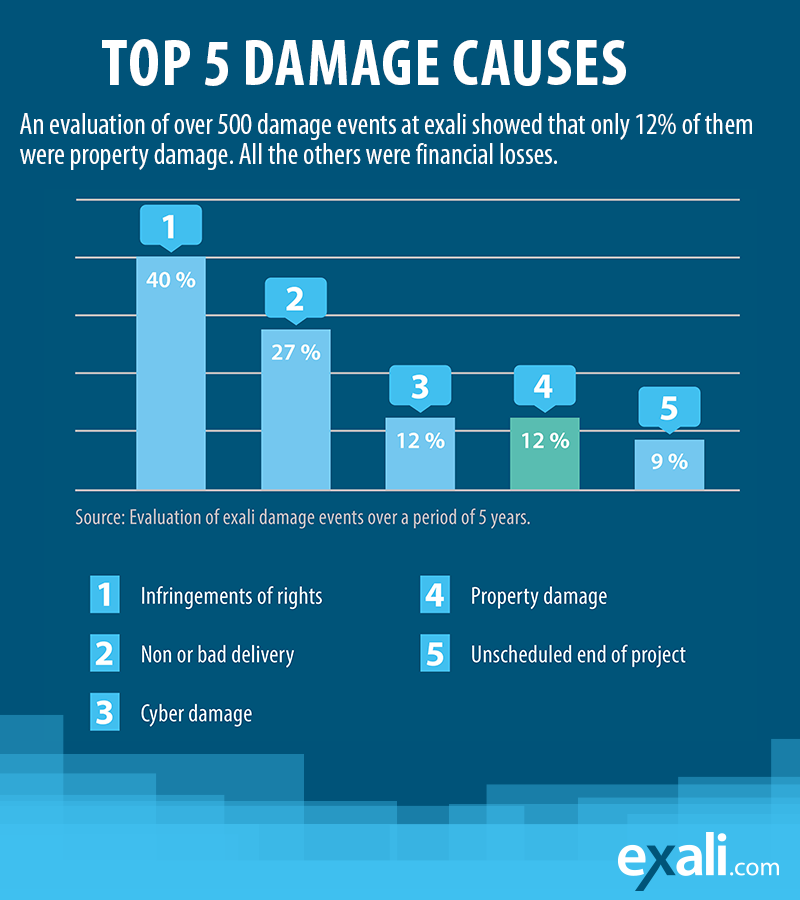

In the best case, Professional Indemnity Insurance provides comprehensive coverage for the professional liability risks of freelancers and the selfemployed. At exali, our experience shows that the majority of reported claims are so-called pure financial losses. An evaluation of the most common causes of damage confirms this:

An analysis of more than 500 exali damage events shows that only about 12 percent of reported claims were property damage - the rest were financial losses.

This article summarises the risks you should always be aware of as a freelancer - regardless of what you do or the sector you work in: 5 Business Risks Freelancers Should Know About

You can find all the important information about so-called pure financial losses on our website.

Particularly in professions where digital tools are used predominantly, pure financial losses are among the greatest risks faced by freelancers and the selfemployed. Here are some examples of what a financial loss can look like:

Business Risks: Legal Violations

Around 40 per cent of all damages reported to exali are actually legal violations. In this article, we have compiled a comprehensive list of possible legal violations and how you can protect your business against them: The 5 Most Common Infringements and how to Avoid them.

Business Risk: Non-/Poor Performance

The term ‘poor performance’ refers to a service that is provided but does not meet the previously defined requirements or expectations. Examples of poor performance are:

All these examples show how quickly a small mistake can have expensive consequences. At exali, we therefore believe that for appropriate coverage, Professional Indemnity Insurance should always include both elements – i.e. a Financial Loss Liability and a General Liability. For this reason, Professional Indemnity through exali always consists of both components – for all industries.

Risk Coverage of General Liability

General Liability insurance generally covers personal injury and property damage, as well as any consequential losses arising therefrom. Property damage is understood to mean the loss, damage or destruction of property. This could happen, for example, if a drone crashes over a car dealership or the damage of a roof window in an office.

In insurance terms, personal injury is a damage event that results in the death, injury or health impairment of persons. This damage event illustrates what such an occurrence might look like: Programming error at the opera stage.

One For All: Professional Indemnity Insurance through exali

Particularly in digital professions, there is a high risk of causing purely financial damage (financial loss) if you make a professional mistake. Nevertheless, property damage or personal injury also happen time and again – even with activities that tend to take place in the digital sector.

In order to cover these risks comprehensively, Professional Indemnity Insurance through exali always consists of two components: a Financial Loss Insurance, which covers purely financial losses, and an Office and General Liability Insurance for property damage and personal injury.

Do you have any questions about Professional Indemnity Insurance through exali, covered risks or damages? Then please feel free to contact our customer service team on +49 (0) 821 80 99 46-0 (available on weekdays from 9:00 a.m. to 6:00 p.m. CET) or use the contact form to send us a message.

Vivien Gebhardt is an online editor at exali. She creates content on topics that are of interest to self-employed people, freelancers and entrepreneurs. Her specialties are risks in e-commerce, legal topics and claims that have happened to exali insured freelancers.

She has been a freelance copywriter herself since 2021 and therefore knows from experience what the target group is concerned about.