Professional Indemnity for Digital Professions

Professional Indemnity Insurance in Greece

exali's Professional Indemnity Insurance for Digital Professions provides comprehensive coverage for you as a freelancer and your business in Greece.

- Comprehensive protection against damage claims

- All-risk coverage for the IT, media and consulting sector

- Worldwide insurance coverage

- Third-party cyber damage is covered

- Personal support without call center

Quick Facts about Professional Indemnity Insurance

Indemnity Insurance Seal for your Principals

- Individual and comprehensive insurance protection

- High coverage sums for financial losses

- No-claims evidence going back five years

The Self-Employed in Greece May Need Professional Indemnity

In general, business owners, freelancers or the self-employed particularly in the IT, media or consulting sector are not always required by law to take out professional indemnity insurance. Nevertheless, it makes sense to take out insurance for your business in Greece, as it is threatened by high financial risk. Warning letters, business interruption or cyber-damage happen more often and quicker than expected. As a freelancer or business owner, you are liable to the extent of your personal or business assets for any claims.

Show Your Liability Insurance to Customers

When awarding a project, clients often require proof of professional indemnity to cover potential risks. After taking out Professional Indemnity Insurance from exali, the Liability Seal is made available to you. So you can show your clients that any damage is well covered as soon as they visit your website.

What Are the Main Business Risks in Digital Professions?

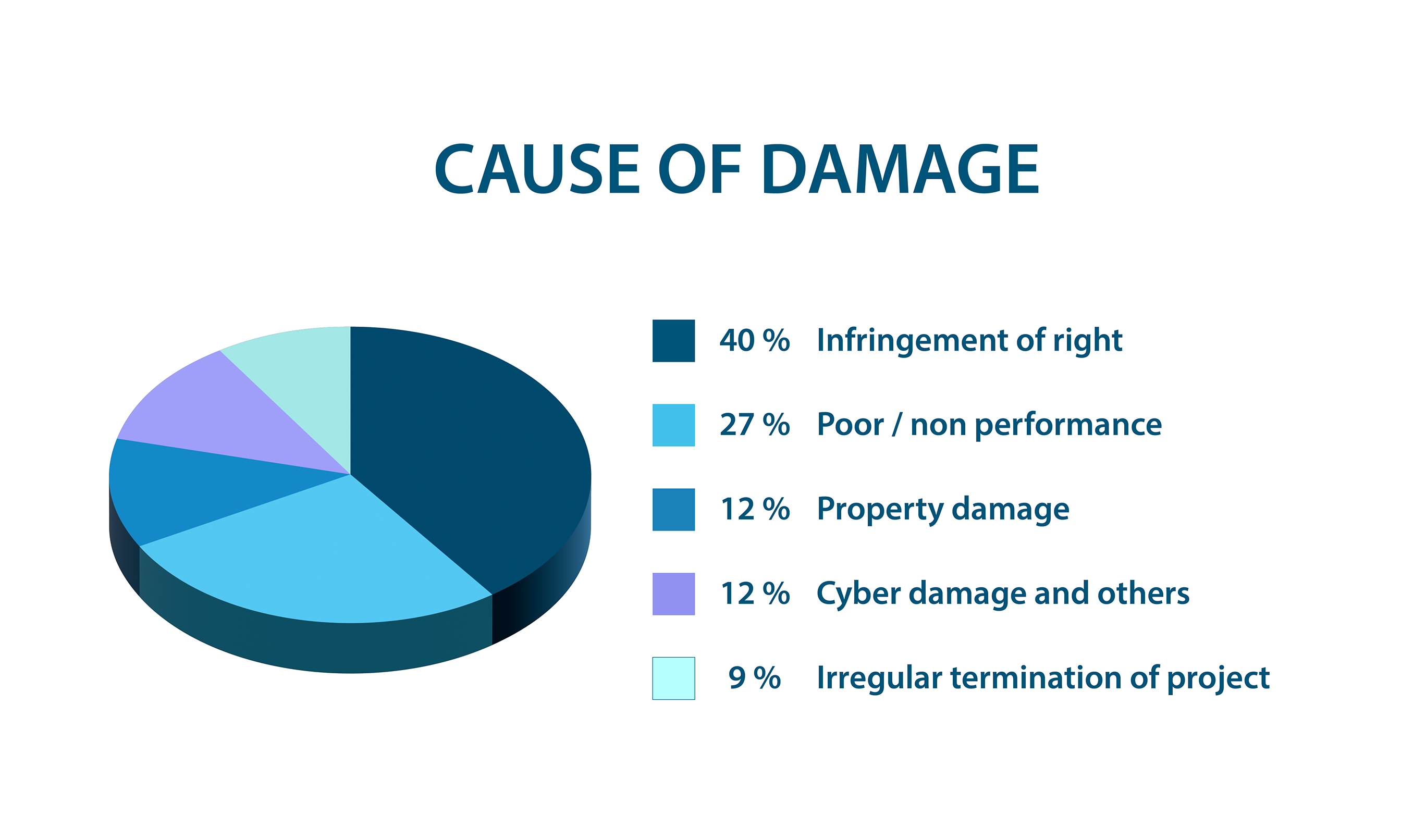

One of the Biggest Risks - Financial Losses

The main risks for business owners and self-employed, particularly in digital professions are financial losses. A financial loss occurs when a third party, for example your client or principal, suffers a financial disadvantage due to professional mistakes. Almost 80 % of the claims reported to exali number among these.

From Server Breakdowns to Legal Infringements

One example for this is a loss of sales by your client due to a faulty server update that paralyses the online shop and for which you are held responsible. However, financial losses can also include consulting and planning errors, project delays and warnings due to legal infringements (e.g. law of competition, image rights, copyright, etc.). Even if you pass on a virus that causes damage to your client's systems unintentionally, that financial loss would be covered by exali's comprehensive Professional Indemnity Insurance.

What Does Professional Indemnity Insurance Do in the Event of a Claim?

A damage claim is always annoying and can quickly threaten your financial existence. With exali you are in good hands and have a personal contact person from exali customer service in the event of a claim. We take care of the professional handling of your case. During the process you benefit from the following services of your Professional Indemnity Insurance:

Verification of Damage Compensation:

In the event of a damage claim, the insurer will check at its own expense whether claims against you are justified and if they are reasonable in amount. Rely on over 15 years of experience in handling professional liability claims.

Defence against Unjustified Claims:

If the claim is unjustified, the insurer will defend you. This so-called "Passive Legal Expenses Insurance" covers also the costs of legal proceedings if necessary, for example, lawyers' fees, court costs or expert costs.

Payment of the Compensation Amount:

If the claim is justified but the amount is excessive, the insurer will help with his experience to adjust it. In this case, the insurer will pay the sum minus the deductible up to the selected amount insured.

What Insured Sum Is Reasonable for Your Business in Greece?

The Main Factor for Your Insured Sum Is the Highest Damage Possible

When choosing the insured sum for your Professional Indemnity, you need to estimate the highest anticipated damage your work could cause. Other important factors include the impact of your service on your client’s success and the size of the project. If you are unsure which insured sum makes sense for your activity in Greece, our experts from exali customer support will be happy to assist you.

With Exali Your Insured Sum Can Be Adapted at Any Time

exali's PI Insurance offers you a choice of insured sums from € 100.000 up to € 3.000.000 for financial losses and from € 2.000.000 up to € 10.000.000 for property damage and personal injuries. Your advantage with exali: You might increase the insured sums of your PI Insurance at any time in the customer area "My exali". This could be necessary whenever your business grows, you take on a large project or your clients demand a higher insured sum.

In addition to the basic cover of exali's Professional Indemnity Insurance, you can protect your business against special risks with optional add-ons.

Protection Against Cybercrime, DDoS Attacks and Viruses: First-Party Cyber and Data Risks Insurance (FPC)

The additional module "First-Party Cyber and Data Risks Insurance (FPC)" protects your own IT systems against the incalculable risks of hacker attacks, DDos attacks and other cybercrime. In the event of a damage to your own systems, the insurer provides you with IT forensic experts and supports you in restoring your systems as quickly as possible. Additional costs incurred, for example, for the use of third-party IT systems, are also covered.

Extend Your Insurance Coverage to Include Engineering Services: Engineering Activities (ENG)

The additional module "Engineering Activities (ENG)" extends your insurance cover to include engineering services such as plant hardware development, machine and plant testing, design, CAD, CAM, commissioning or technical reports. It is a condition of the endorsement that the activities are carried out in an advisory and supportive capacity and that you do not provide the engineering services on a contract for work and do not owe any engineering services.

What Does Professional Indemnity Insurance Cost in Greece?

How Your Insurance Premium Is Calculated

The minimum premium for exali's Professional Indemnity Insurance is € 133,10*. Your individual insurance premium is calculated on the basis of:

- Your annual net turnover (a higher turnover means a higher contribution)

- Your selected sums insured (higher sums mean a higher premium)

- If you have selected additional modules

Benefit From Exclusive Discounts

As a business start-up, you also receive a discount of 15% during the first two years of your contract. Should you take out a 3-year contract, you will also benefit from a term discount of 10% per insurance year. In the premium calculator, you can put together your Professional Indemnity Insurance individually with just a few clicks and see directly how the individual items affect the premium.

Why choose exali.com

- Talk to a real person - no call centre!

- We know what your daily worklife is like, meaning we know what you need

- Our insurance conditions are tailored to your business

- We handle your damages immediately

- We make sure that your insured damage event is also resolved!

- We also insure against unusual risks (e.g. contract liability, contract penalties)

Frequently Asked Questions

Who Can Be Co-Insured in the Professional Indemnity Insurance in Greece?

What Are the Contractual Exclusions?

What Is the Minimum Duration of Your Professional Indemnity Insurance in Greece?

Which Legal Forms can be Insured?

In What Parts of the World is Your Business Protected by Professional Indemnity Insurance (Geographical Limits)?

How Do I Report a Claim?

Which Professional Activities in Greece Are Covered by Professional Indemnity Insurance?

Professional Indemnity Insurance from exali automatically covers all activities typically performed by a Greek freelancer or a Greek company in the IT, media or consulting sector. This principle is called "All-risk coverage" - and it ensures that the insurance cover always automatically adapts to your business model. The only activities that are not covered are those that have been explicitly excluded in the insurance conditions.

A Small Selection of Activities Insured in the Professional Indemnity Insurance:

- Database developer

- Programmer

- Software engineer

- Computer scientist

- Web developer

- Java developer

- App developer

- Service provider

- Internet provider

- IT service provider

- IT Manager

- Project director

- Network supervisor

- System administrator

- IT specialist

- Software dealer

- Author

- Content agency

- Photographer

- Freelance journalist

- Graphic designer

- Illustrator

- Influencer

- Marketing agency

- Media agency

- Editor

- SEM agency

- SEO/SEA

- Social media consultant

- Social media agency

- Web designer

- Advertising agency

- Management consultant

- Business analyst

- Strategy consultant

- Organisational consultant

- HR consultant

- Recruiter, headhunter

- Interim manager

- Project manager

- Energy consultant

- Marketing consultant

- Market researcher

- Pollsters

- Quality manager, auditor

- Lecturer, trainer, coach

- Mediator, moderator

- Family advisor

- Accounting assistant

- Accountant

- Office service company

- Call centre service provider

- Detective agencies

- Nutritionist

- Fitness trainer

- Payroll service

- Appraiser

- Wedding planner

- Motor vehicle expert

- Mental coach

- Expert

- Secretarial activities

- Virtual assistance

- Zumba teacher

- Hard- & software development

- Embedded software

- Machinery testing

- Technical drawings

- Technical design (CAD, CAM)

- Commissioning

- Engineering services

- Technical consultancy